As markets shift and stakeholder voices grow stronger, Environmental, Social, and Governance (ESG) principles have become central to how leadership is defined. The dialogue around sustainability is actively influencing how capital is allocated and shaping strategies across industries. Amid this momentum, Global ESG assets surpassed $30 trillion in 2022 and are on track to surpass $40 trillion by 2030. This marks a fundamental realignment of what the financial world considers valuable.

Today, the focus is on building resilient, future-ready businesses—those that drive innovation, foster trust, and align with long-term societal goals. ESG factors are guiding investment decisions, shaping corporate behavior, and setting the tone for a new era of finance.

This blog explores how sustainable investing strategies are defining that new era through strategic insight, measurable impact, and forward-looking financial leadership.

The Strategic Importance of ESG in Corporate Finance

In a dynamic financial ecosystem, ESG has become a strategic cornerstone of corporate decision-making. Organizations are increasingly integrating Environmental, Social, and Governance (ESG) considerations into their core business frameworks as a mechanism to drive sustainable value creation. This alignment enhances corporate resilience, builds stakeholder trust, and strengthens long-term access to capital.

The shift is also evident in global capital flows. ESG fund assets grew by 37% in 2023, reaching $1.8 trillion, underscoring the accelerating momentum behind sustainable investing. The growing relevance of ESG in corporate finance stems from several key drivers:

- Alignment with stakeholder priorities: Investors, regulators, customers, and employees increasingly expect companies to demonstrate transparency, accountability, and social responsibility.

- Data-informed strategic planning: Materiality assessments enable companies to identify the ESG factors most relevant to their operations and risk landscape, guiding the development of measurable sustainability goals.

- Enhanced risk mitigation and governance: ESG-aligned organizations are better positioned to anticipate regulatory shifts, manage reputational exposure, and navigate environmental or operational disruptions.

As ESG becomes integral to strategy, the question now is—who’s validating the progress? The answer lies in a growing but often overlooked pillar of sustainability: independent audits and assurance.

The Role of Audits in ESG and Sustainability

As ESG commitments take centre stage in corporate strategy, audits are becoming essential to ensure that those commitments are not just aspirational but evidence-based. Unlike traditional financial audits, ESG audits involve highly qualitative and complex data—ranging from social impact to governance ethics—often without the benefit of standardized metrics.

The growing concern about greenwashing, where companies exaggerate or misrepresent their ESG efforts, has further heightened the importance of assurance. With growing pressure from investors, regulators, and the public, the need for accurate, verifiable ESG data is critical. Auditors now play a vital role in validating disclosures, thereby strengthening the trust of stakeholders.

Delivering meaningful ESG assurance requires auditors to move beyond conventional checklists. It demands:

- Specialised methodologies for materiality assessments

- Familiarity with evolving ESG frameworks (GRI, SASB, TCFD, ISSB, etc.)

- Sector-specific understanding of what ESG risks matter most

- Sound professional judgement to interpret qualitative insights alongside quantitative data

Given the diversity of reporting approaches, consistency and comparability remain key challenges. Technology is stepping in to support this evolution—blockchain enables traceable, tamper-proof ESG records, while AI and big data analytics enhance the speed and precision of risk detection, anomaly analysis, and audit sampling.

As the demand for credible ESG data grows, the need for consistent and standardized reporting frameworks becomes equally critical.

Protocols and Standards in ESG Reporting

As ESG reporting continues to mature, companies are under increasing pressure to present data that is not just transparent but also consistent and globally credible. Over the years, international institutions have stepped up to this challenge by developing structured reporting frameworks tailored to various dimensions of sustainability.

Here’s how the most widely adopted ESG reporting frameworks compare:

| Framework | Primary Focus | Audience | Strengths |

| GRI (Global Reporting Initiative) | Broad sustainability topics like labor and human rights | Stakeholders at large | High transparency, stakeholder-centric |

| SASB (Sustainability Accounting Standards Board) | Financially material ESG issues | Investors and regulators | Sector-specific, financially integrated |

| TCFD (Task Force on Climate-related Financial Disclosures) | Climate risk and financial impact | Investors, boards, and CFOs | Forward-looking, risk-based disclosure |

While these frameworks are designed to clarify ESG performance, their differences can lead to inconsistencies in how companies report their data. To ensure that ESG reporting is practical and actionable, companies must align their internal protocols with the expectations set by these global standards.

The process typically involves:

- Conducting a materiality assessment to identify ESG risks and opportunities most relevant to both business goals and stakeholder concerns

- Developing clear ESG policies and goals, supported by measurable KPIs and governance structures

- Engaging independent auditors to verify ESG data, assess alignment with reporting standards, and ensure accountability across the organization.

When done well, this alignment not only enhances the credibility of reporting but also builds reputational capital and investor trust. ESG reporting is moving toward the same level of scrutiny and sophistication as financial reporting. By embedding robust ESG protocols now, businesses can future-proof their reporting, deepen stakeholder confidence, and set the pace for the next generation of corporate transparency.

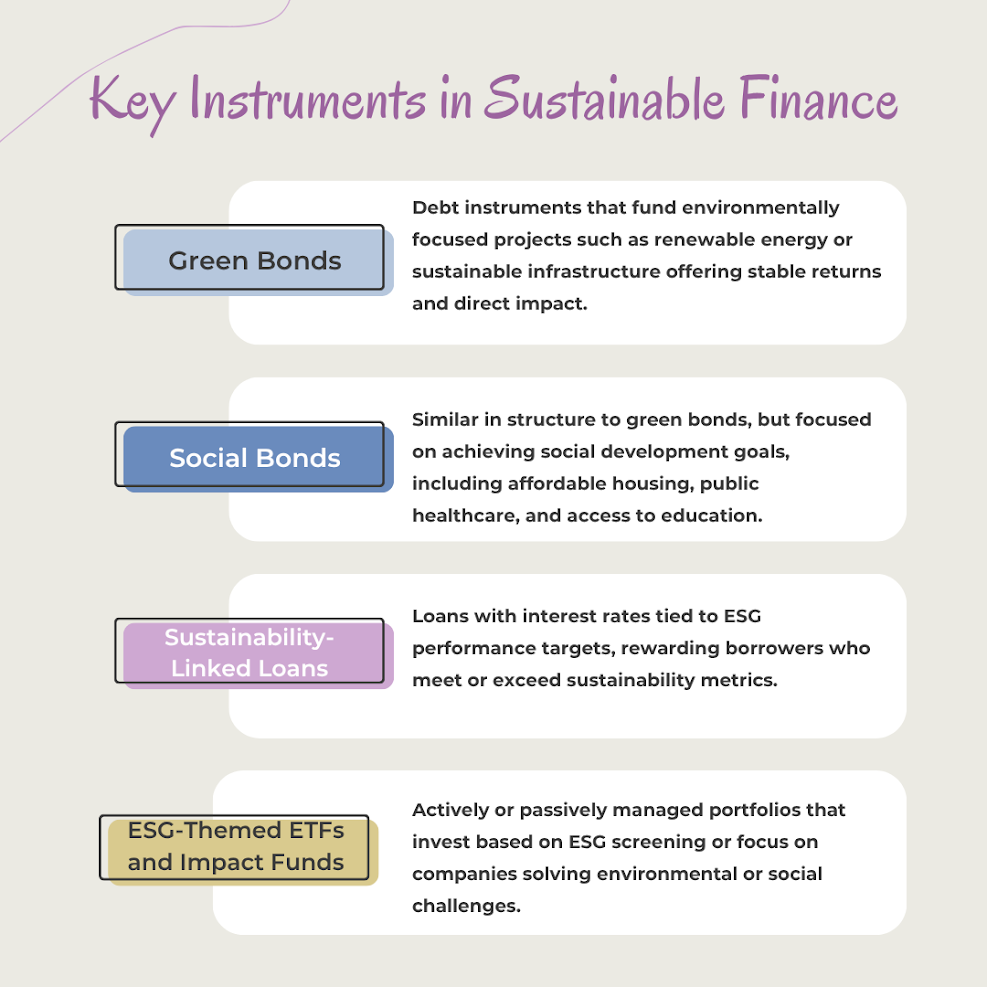

Sustainable Finance: Instruments and Innovations

As principles become embedded in ESG investment philosophy, financial instruments designed to deliver both economic returns and measurable social or environmental impact are experiencing growing demand.

Institutional investors, including pension funds and insurance companies, are increasingly leveraging ESG-focused products to hedge long-term risks associated with climate change, inequality, and resource scarcity. Simultaneously, retail investors, especially younger generations, are seeking ESG investments that align with their values, driving innovation across the financial sector.

This combined demand has accelerated the development of various ESG-themed financial instruments. (Refer to the image below for a quick comparison of these tools.)

As adoption expands, these instruments are expected to play a pivotal role in redirecting capital toward organizations that align purpose with performance. Making the most of these tools starts with the right strategy and guidance.

ESG Advisory: Strategic Implementation and Best Practices

Building a credible ESG strategy requires a structured approach, stakeholder alignment, and specialized expertise. A practical ESG roadmap must be rooted in a company’s specific operating environment. It begins with a materiality assessment, which identifies the ESG risks and opportunities most relevant to the business and its stakeholders. This process typically includes input from employees, customers, investors, regulators, and supply chain partners.

Once material issues are clear, ESG consultants help organizations:

- Set measurable ESG goals and targets

- Develop clear action plans and ownership structures

- Integrate ESG into core business functions like HR, procurement, product, and operations

- Align performance incentives, including executive compensation, with ESG outcomes

A strong ESG strategy also relies on having accurate and accessible data. Consultants support the implementation of systems for ESG data collection, reporting, and performance tracking, ensuring that KPIs are not only defined but also regularly monitored and updated. Internal training is often part of this process, building ESG literacy and long-term accountability across the organization.

A common pitfall is relying on generic, boilerplate disclosures. Vague ambitions and surface-level statements can undermine trust. Advisory partners help companies shift from compliance-driven reporting to purpose-led narratives, rooted in measurable outcomes and real progress.

But strategy alone isn’t enough—governance is what ensures it’s upheld and embedded across the organization.

The Role of ESG in Corporate Governance

For ESG to be effective, it must be embedded at the highest levels of decision-making. Governance is the mechanism that ensures Sustainable investing strategies are upheld, monitored, and continuously improved. Boards and leadership teams are no longer tasked solely with financial oversight; they are also expected to provide strategic guidance.

A well-governed ESG framework begins with clear ownership at the top. This includes integrating ESG responsibilities into board charters, assigning oversight to specific committees or directors, and ensuring ESG goals are part of executive performance evaluations. Governance structures that prioritize ESG create accountability and encourage long-term thinking. Three factors are especially critical in enabling ESG-driven governance:

- Diversity in Board Composition: A diverse board—across gender, experience, age, and background—brings broader perspectives to sustainability and social equity. This diversity supports better decision-making and more substantial alignment with stakeholder expectations.

- Ethical and Transparent Leadership: ESG success depends on leadership that models integrity and long-term responsibility. Codes of conduct, ESG-aligned policies, and culture-setting at the executive level help translate commitments into day-to-day action.

- Stakeholder Accountability: Governance must ensure regular, transparent engagement with key stakeholders—from investors and regulators to employees and communities. Credible disclosures and feedback mechanisms help build trust and reinforce a company’s ESG credibility.

Without strong governance, ESG strategies risk becoming performative. But when governance is structured, intentional, and value-driven, it becomes the backbone of a company’s transformation, turning ESG from a reporting exercise into a leadership principle.

Conclusion

When Apple, Microsoft and Nestlé prioritize ESG, it signals a global realignment in how value is defined. From climate disclosures to ethical sourcing, industry leaders are demonstrating that sustainability is now integral to financial performance. As the finance sector continues to evolve through innovation, transparency and inclusion, ESG stands as the framework that ensures resilience and long-term trust.

For investors, institutions and regulators, the way forward is to embed ESG more deeply, align with greater urgency and build a financial system where progress is both measurable and meaningful.